Investment

Properties News

June 2022 Dubai Real Estate Market Report

Real estate prices have just recorded their first monthly decline in 2022.

Falling by 0.31% in June. And with the world economy looking unstable at the moment, this may look bad at first But wait until you hear this… Even though property prices fell, The volume of transactions has increased! That’s 34.2% higher than the previous month. And 38.8% higher Than 2021!

This shows that there is nothing to worry about the prices falling by 0.31% is a sign of a healthy market that can grow sustainably.

But let’s dive deeper: New off plan development projects are on the rise! 5175 new units have entered the market for sale worth AED 13 billion. And many of these are bought using a mortgage which is on the rise! More people are taking mortgages now than ever, With June Recording the highest number of mortgages taken! This has made the mortgage volume Jump by 40.5% in June, and almost half of the loans taken Are for residential properties!

And here’s more good news!

In June, emirate-wide average gross rental yields rose to 6.37% , the highest level since pre-pandemic! As a result further growth in yields are expected over the coming months !

DUBAI PROPERTY MARKET OVERVIEW

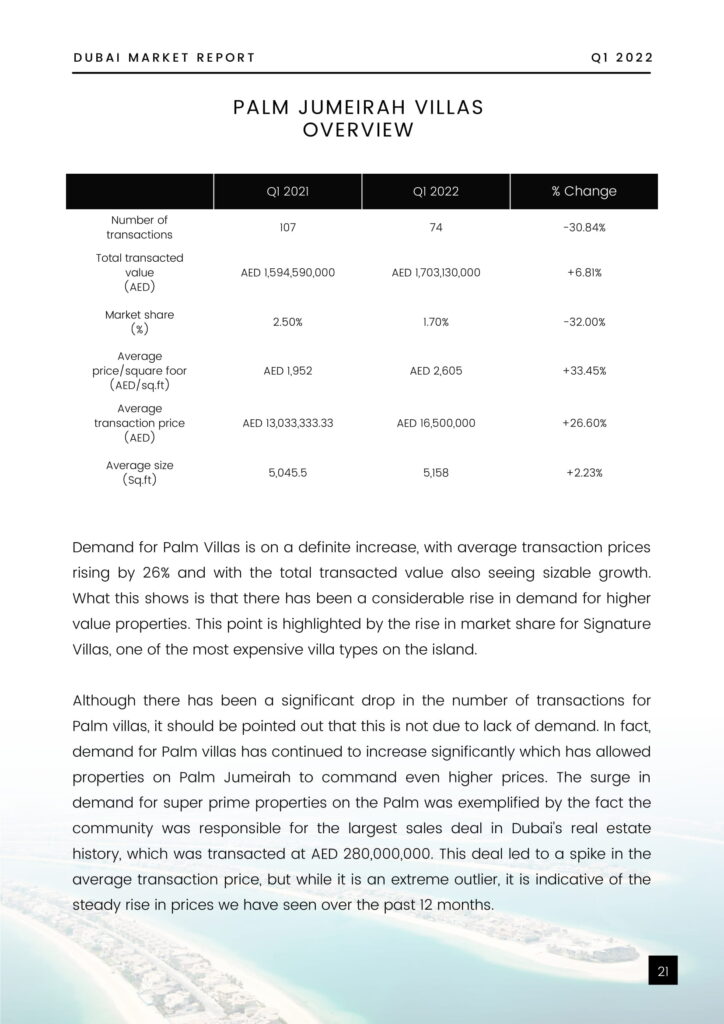

The Dubai property market has all but recovered from the effects of

the Covid pandemic. Q1 has been a period that has seen the city

deliver a number of records being broken within the real estate

market, including the largest single sale transaction in Dubai’s history,

with the AED 280 million sale on Palm Jumeirah. This sales transaction

exemplifies how the luxury property sector in Dubai is seeing

increasing demand.

Our analytics data shows a 400% year-on-year increase in digital

traffic for villas and apartments in the Prime and Super Prime space.

This is reflected by the high numbers of HNWIs coming to Dubai to buy

a principal residence or an investment property. In recent years,

Dubai has thoroughly established itself as a prime global destination

for purchasing a home, which has led to overall transaction prices

continuing their year-on-year growth so far in 2022.

Villa communities, which saw a surge in demand following the onset

of the Coronavirus pandemic, are continuing to see a very high level

of enquiries, with inventory issues now coming to the fore. This has led

to an increase in prices for these communities, which has pushed

some buyers toward purchasing off-plan villas and larger

apartments.

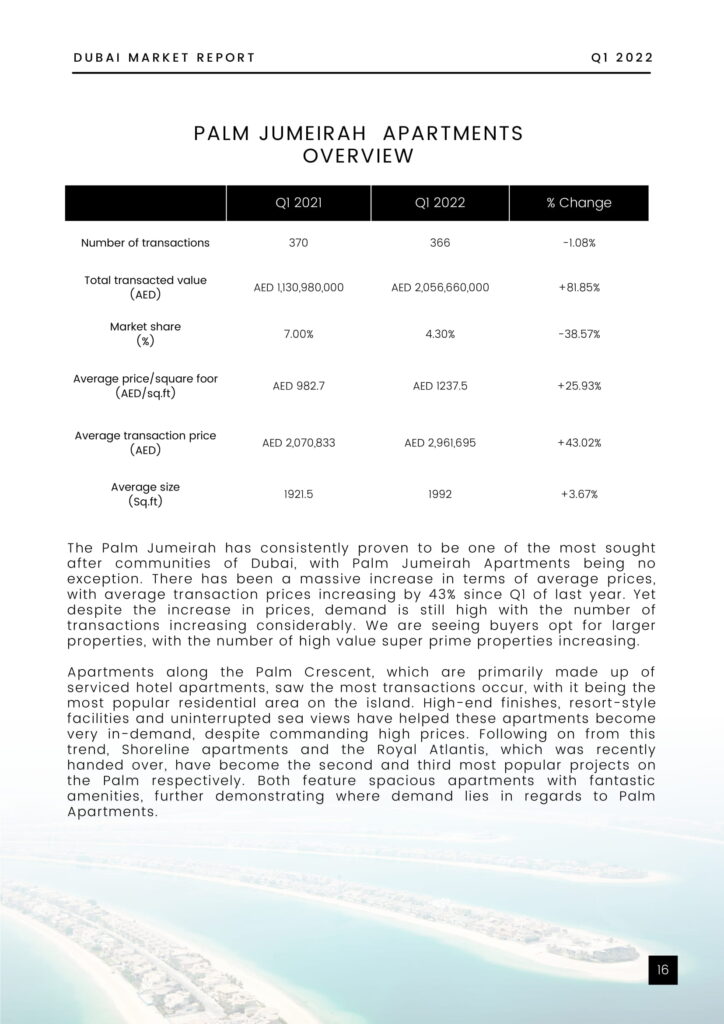

Apartment complexes with high-end resort style amenities, such as

those in Downtown and Palm Jumeirah, have seen a massive uptick in

both interest and transactions. This move towards apartments helps

to explain why average property sizes have gone down, despite

average transaction prices increasing.

This flurry of demand for prime and super prime apartments has also

pushed prices up, causing considerable year-on-year growth. With

the lack of available inventory in villa communities, we envisage the

number of transactions for apartments to continue rising - this will be

further supported by the few numbers of off-plan projects that are set

to hand over in the coming year.

Dubai’s property sector finds itself in a very strong and stable position

as of Q1. Geopolitical tensions elsewhere in the world serve only to

underpin Dubai’s position as a safe haven especially in terms of the

Prime and Super Prime property segment. Q1 is indicative of what the

remainder of 2022 has to offer. Dubai is well placed to have a solid

year ahead, with the expectation being continued growth in the short

to medium term.